The Quiet Thaw? Why 2026 is the Year for US Universities to Return to China

For U.S. universities, recruiting in China can feel like trying to steer by lightning: headlines about geopolitics, visa risk, and trade conflict dominate the news cycle, while the factors that actually shape student decisions move more quietly. In 2026, those quieter signals are unusually worth tracking. Five of them point toward a friendlier environment for U.S. institutions that are willing to get on a plane and rebuild in-person trust.

Quick Read: 2026 Signals to Watch

Two upcoming Trump-Xi meetings could soften tone and lower perceived risk.

Chinese economic growth and a stronger RMB will make overseas tuition more affordable.

Students in tier 2-3 cities rate on-campus fairs and counseling centers as most credible, so travel matters.

Chinese cultural confidence is growing with international hits like Labubu, which might signal shifts in preferences for majors.

2026 may offer a reputational reset if World Cup visitor experiences are positive. China’s internet will be watching.

1. A Summit Calendar that May Soften the “Tone Environment”

There’s credible public reporting that President Trump plans to visit Beijing in April 2026, and that a reciprocal Xi visit to the US is also being discussed. Recruiters shouldn’t assume a diplomatic breakthrough. But summits reliably create a “run-up window” where official messaging becomes less incendiary and more stability-oriented. In the lead-up to the Biden-Xi meeting around APEC in San Francisco (November 2023), reporting noted a noticeable shift in Chinese state media tone compared with prior periods of tension. We’re already seeing some of this play out in the US. For example, the US approved conditional sales of Nvidia’s H200 AI chips to China.

What we’re looking out for:

Official readouts and language on “people-to-people exchanges” or “stability.”

State-media framing of U.S. society and “study abroad” narratives as April approaches.

Why it matters: even small reductions in rhetorical heat can lift parent confidence, improve yield, and make school-counselor partnerships easier to sustain.

2. In 2026, Economic Shifts in China Make Tuition More Affordable

Economists are forecasting that China’s economy will grow by 4.8% in 2026, bearing prior expectations. Recent reports show that China’s trade surplus hit a record $1.2 trillion in 2025, underscoring export resilience even under renewed tariff pressure. Crucially, the Chinese Yuan has strengthened against the dollar, including moving below the psychologically important 7 RMB/USD threshold near the end of 2025—levels not seen since 2023—improving perceived affordability for tuition compared to previous years..

What we’re looking out for:

The strength of the Chinese Yuan against the dollar and whether it stays below 7:1.

Export growth and trade-balance updates as a proxy for household confidence.

Why it matters: a stronger RMB doesn’t solve every concern, but it directly improves the cost conversation, especially for families comparing the U.S. with other high-tuition destinations.

3. Trust Is Being Built Inside Schools and Communities

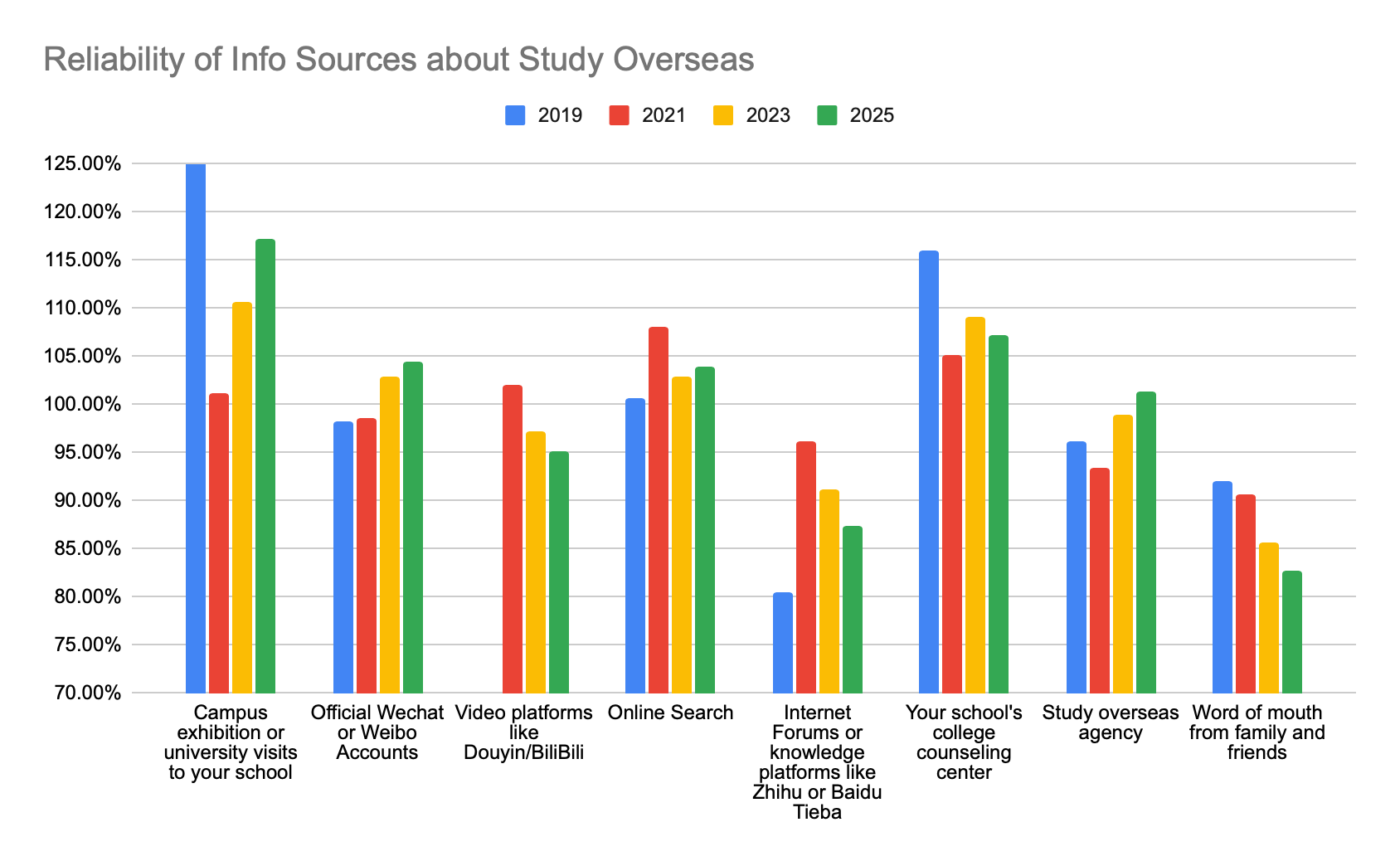

A third quiet signal is where credibility is consolidating inside China’s own education ecosystem. In surveys of Chinese high school students at Sunrise’s recruitment fairs in tier 2 and 3 cities in China, students ranked college fairs hosted on their own campuses as the most reliable source among ten information channels about study overseas, and they reported that they relied most on their in-school college counseling centers.

At the same time, the “agent market” is changing shape rather than disappearing. Compared with 2019, 16% more students say they use independent education consultants, but they’re increasingly choosing boutique advisors or smaller-scale agents.

What we’re looking out for:

A bounceback of US recruitment travel to tier 2 and 3 cities in China.

Recruitment travel as ways to build connections, not only at college fairs, but with boutique counseling firms who don’t often attend overseas recruitment conferences.

Why it matters: in 2026, travel isn’t just a marketing tactic; it’s how institutions stay proximate to the trust infrastructure that increasingly determines whether students convert from interest to enrollment.

4. Chinese Cultural Confidence Is Rising, Which Might Expand Interest Beyond “Safe” Majors

A fourth quiet signal is cultural rather than political: China is becoming more confident in the global reach of its own creative industries, and that confidence might start to reshape what subjects students major in. The last few years have produced a run of internationally visible successes: Ne Zha 2 as a global box-office phenomenon in 2025, Pop Mart’s Labubu as a breakout global collectible brand/IP, Mixue scaling into one of the world’s largest chain footprints, and Black Myth: Wukong as a symbol of ambition in high-end game production. This reinforces a simple idea for students: global influence isn’t only manufactured through engineering and finance; it can also be built through design, storytelling, IP, and creative technology.

For U.S. universities, the recruitment opportunity is that this shift doesn’t replace demand for “safe” majors—it adds a second track of ambition. Students who might previously have defaulted to engineering, business, or economics are now more open to pairing those pathways with creative domains: game development, animation, digital media, UX/UI, creative computing, product design, entertainment business, marketing, and global brand strategy.

What we’re looking out for:

Increased demand for majors and minors that sit at the intersection of creativity and industry.

Stronger interest in programs that can credibly connect students to global creative ecosystems such as capstone projects, industry mentors, production labs, and internships.

Why it matters: in 2026, universities that can speak fluently about both “security” (employability, ROI, skill-building) and “identity” (creative ambition, cultural relevance, global impact) will resonate more strongly with the next cohort of Chinese applicants.

5. A “Second Chance” Reputational Moment: The 2026 World Cup

Finally, 2026 offers a rare soft-power opportunity: the FIFA World Cup in North America (June 11–July 19, 2026), with massive global demand already visible in ticketing. Chinese domestic commentators will absolutely watch the lived experience of visitors: visa treatment, safety, hospitality, transit, racism narratives, and more broadly the question: “is the U.S. welcoming?”

What we’re looking out for:

Chinese-language social and video platforms’ narrative about experiences from visa applicants and visitors at games.

Travel-adjacent sentiment that spills into “is studying in the US safe?”

Recruitment implication: universities that are active in China before the World Cup narrative wave can ride the upswing if perceptions improve.

In 2026, the loudest headlines about US-China relations will remain volatile, but the quieter indicators point to a more constructive direction for recruitment. With summit diplomacy likely to moderate tone in the short term, affordability pressures easing as the RMB strengthens, and trust consolidating inside high schools and boutique counselor networks, the practical conditions for US universities to re-engage on the ground through recruitment travel look better than they have in several cycles.