An Introduction to China’s Short Video Social Media Scene

Fueled by the pandemic, the popularity of videos is skyrocketing in China, particularly among teenagers. The value of the Chinese short video market is expected to reach 211 billion RMB in 2021. As of August 2020, video-sharing platform Douyin had 600 million daily active users, up 50% from January. Similarly, as of early 2020, its rival Kuaishou has 305 million daily active users, who spend an average of 86 minutes on the app. Social media giant WeChat, with over 1.2 billion monthly active users, recently launched a video channel to compete with these services.

Once dedicated to lighthearted, funny videos, these social media platforms increasingly feature serious topics, including the efforts of front line workers to fight the coronavirus and the reporting of citizen journalists.

Meanwhile, Bilibili, a long-form video platform that synthesizes features of YouTube and Netflix, is experiencing a resurgence — it reported 70% year-on-year growth in the first quarter of 2020.

The trend towards video has already transformed marketing in China. For example, last year JD.com partnered with influencers on Kuaishou to livestream programs related to its annual 618 Shopping Festival. During the livestreaming, customers flooded JD.com with 10,000 orders per minute.

In another example, Ziroom, an internet company that offers rental services, posted VR and video house viewings to attract clients.

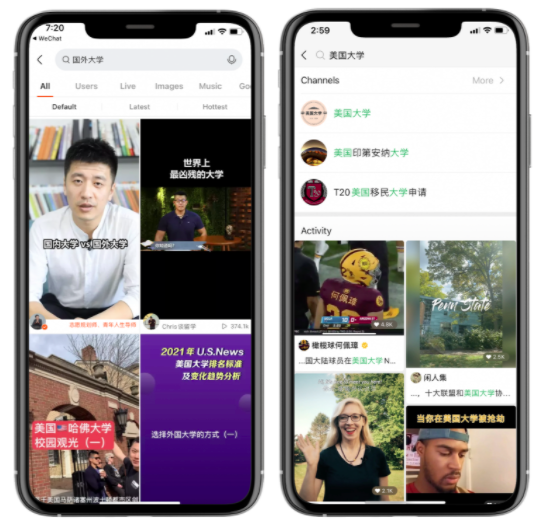

So far, global higher education institutions haven’t joined the trend, but these video-sharing sites offer a unique opportunity to engage with hundreds of millions of students and will likely emerge as a crucial recruitment tool over the next few years. Content related to education has boomed; Douyin launched “Online Classroom” as a medium for teachers to distribute materials and offer free classes to primary and middle school students. Educational content reigns as one of the most popular topics on Bilibili — over 50 million users viewed educational content in 2019. Moreover, these platforms’ demographics closely align with those of universities. The majority of Douyin’s users are younger than 35 years old, and they are mostly concentrated in tier 1 and tier 2 cities.

Bilibili fills a long-form video niche. The short-form video market is currently dominated by Douyin and Kuaishou, but WeChat has a competitive advantage in that it has over 1.2 billion monthly active users. However, these three companies don’t offer identical services, and understanding the differences and intricacies of each platform is crucial.

Be on the lookout for more articles, as Sunrise will continue this series to offer more insights into China’s social media scene. Reach out to contact@sieconnection.com to discuss how you can leverage videos for your advertising campaign.